Certificates of insurance coverage extra insured unlocks a gateway to shared safety, guaranteeing that everybody concerned in a venture or transaction is roofed. Understanding the nuances of this significant doc empowers you to navigate complicated authorized landscapes with confidence, selling concord and safety in each endeavor. This information will delve into the intricacies of extra insured protection, from its foundational ideas to sensible purposes, enabling a deeper comprehension of its transformative potential.

The certificates of insurance coverage, a vital doc within the realm of threat administration, usually contains extra insured endorsements. These provisions are crucial in extending protection to events past the named insured. Understanding these clauses and their implications is significant for safeguarding numerous stakeholders, fostering collaboration, and mitigating potential monetary losses.

Understanding Further Insured Protection

Further insured protection on a certificates of insurance coverage is an important part for companies and people who need to defend themselves from legal responsibility. It extends safety to events not named as major insureds on the coverage, including a layer of security and lowering the chance of monetary publicity. Understanding the intricacies of extra insured endorsements is paramount for making knowledgeable selections and guaranteeing complete safety.Further insured endorsements, also known as “extra insured” or “AI” endorsements, are particular clauses inside a business insurance coverage coverage that grant legal responsibility safety to events past the named insured.

This added safety is significant in situations the place the named insured may be held liable for the actions of others, akin to contractors, distributors, and even unbiased brokers. The bottom line is to determine who’s being coated and the particular conditions the place that protection applies.

Kinds of Further Insured Endorsements

Numerous kinds of extra insured endorsements exist, every with distinctive provisions and implications. These endorsements tailor the protection to particular circumstances, offering a versatile and adaptable safety system. Understanding these differing types is important for choosing probably the most acceptable protection.

Particular Endorsement Sorts and their Implications

Understanding the exact language and phrases inside extra insured endorsements is crucial. Ambiguity can result in gaps in protection and doubtlessly pricey liabilities. The language used defines the scope of safety, figuring out who is roofed and beneath what circumstances. Thorough evaluate and interpretation are important to keep away from misunderstandings.

Comparative Evaluation of Further Insured Protection Sorts

The next desk illustrates the distinctions between numerous extra insured protection sorts. It highlights the protection supplied, potential limitations, and illustrative examples.

| Kind of Endorsement | Protection Supplied | Limitations | Examples |

|---|---|---|---|

| Contractual Further Insured | Gives protection to events laid out in a contract, sometimes for work carried out by the insured or on their behalf. | Protection is commonly restricted to the particular contractual obligations and obligations. It might not cowl all potential liabilities. | A basic contractor hiring a subcontractor, or a producer holding a product legal responsibility declare by a retailer. |

| Automated Further Insured | Gives protection to events who’re often working with the insured, sometimes beneath particular circumstances. | The exact scope of protection could range primarily based on the particular coverage language and circumstances. | A constructing proprietor who hires a tenant or contractor often for upkeep. |

| Particular Further Insured | Gives protection to a selected occasion or events recognized by identify. | Protection is restricted to the named people or entities and doesn’t lengthen to others. | A producer naming a distributor as a further insured on their product legal responsibility coverage. |

Scope and Software of Further Insured Protection: Certificates Of Insurance coverage Further Insured

Further insured protection extends legal responsibility safety to events aside from the named insured, usually crucial for safeguarding numerous pursuits in a venture or transaction. Understanding the circumstances beneath which this protection is required, the potential dangers of its absence, and the conditions the place it is not essential is important for making knowledgeable selections about insurance coverage insurance policies.This part delves into the specifics of extra insured endorsements, outlining the circumstances that necessitate their inclusion and the implications of their omission.

It additionally offers a framework for figuring out when extra insured protection is, and is not, a prudent measure.

Circumstances Requiring Further Insured Protection

Further insured protection is commonly required when a venture or transaction includes a number of events with potential legal responsibility. That is essential to make sure that all events are protected in case of claims arising from the venture or work carried out. Examples embrace:

- Subcontractors and Distributors: When a basic contractor engages subcontractors or distributors, extra insured protection could also be essential to guard the subcontractors or distributors from claims associated to the venture. That is particularly crucial when the work includes potential dangers.

- Lenders and Monetary Establishments: In development tasks, lenders or monetary establishments could require extra insured standing to guard their pursuits within the property or the venture. This safety is commonly tied to the potential of claims associated to development actions.

- Leaseholders and Tenants: In conditions the place a property proprietor has contracted work, leaseholders or tenants would possibly want extra insured protection to guard their pursuits, notably in relation to work carried out on the property.

- Joint Ventures and Partnerships: In a three way partnership or partnership, all concerned events have to be included within the protection to make sure that every participant is protected in opposition to liabilities stemming from the shared venture.

Potential Dangers of Inadequate Further Insured Protection

Failing to safe acceptable extra insured protection can expose numerous events to vital dangers. These dangers usually contain monetary repercussions and authorized challenges.

- Monetary Publicity: With out extra insured protection, the events concerned in a venture may very well be held personally accountable for claims associated to the venture. This can lead to substantial monetary losses for these with out adequate insurance coverage safety.

- Authorized Challenges: Lack of extra insured protection might result in authorized disputes and protracted litigation. This may contain vital prices related to authorized illustration and potential judgments.

- Venture Delays and Disruptions: The specter of authorized motion and monetary publicity can considerably delay or disrupt tasks, doubtlessly impacting venture timelines and budgets.

Conditions The place Further Insured Protection May Not Be Wanted

In sure circumstances, extra insured protection won’t be essential. This depends upon the particular contractual agreements and the character of the actions concerned.

- Clearly Outlined Legal responsibility Limits: If the first insured’s legal responsibility limits are sufficient to cowl potential claims and there’s clear contractual language in regards to the duty of every occasion, extra insured protection won’t be important.

- Impartial Contractors with Satisfactory Insurance coverage: If the subcontractor or vendor has adequate insurance coverage protection that explicitly addresses their obligations and legal responsibility, extra insured protection might not be required.

- Low-Threat Actions: In circumstances involving low-risk actions or minimal potential for claims, extra insured protection won’t be financially useful or essential.

Resolution-Making Flowchart for Figuring out Further Insured Wants

The next flowchart offers a basic information for figuring out the necessity for extra insured protection.[Note: A flowchart is not supported in this format. A visual flowchart would depict steps like assessing project complexity, identifying potential liabilities, evaluating the primary insured’s coverage, and considering contractual agreements. This would lead to a determination of whether additional insured coverage is required.]

Certificates of Insurance coverage Clauses and Further Insured

Understanding the clauses in a certificates of insurance coverage, notably these associated to extra insured standing, is essential for guaranteeing correct safety. These clauses outline the scope of protection and obligations, defending each the insured and the extra insured events. Navigating these clauses requires cautious consideration to element and a transparent understanding of the coverage’s phrases and circumstances.

Widespread Clauses Associated to Further Insured

Certificates of insurance coverage usually embrace particular clauses that Artikel the circumstances beneath which a further insured occasion is protected. These clauses sometimes specify the kinds of operations, areas, and timeframes coated. Examples embrace:

- Operations Clause: This clause particulars the particular operations or actions coated by the coverage. For example, a development venture would possibly specify that protection applies solely to actions associated to the venture, excluding any unrelated work. This clause clearly defines the boundaries of the extra insured’s protection.

- Location Clause: This clause Artikels the geographical areas the place the extra insured is protected. For instance, protection may be restricted to the venture website, or to the venture website and its fast environment. That is essential for guaranteeing that the extra insured is roofed within the right areas.

- Time Interval Clause: This clause defines the period of protection for the extra insured. It sometimes spans from the graduation of the venture till its completion, or a specified finish date.

Authorized Implications of Clauses

The authorized implications of those clauses are vital. A poorly drafted or ambiguous clause can result in disputes and potential legal responsibility points. For instance, if a clause is simply too broad, the insurer may be obligated to cowl unexpected occasions or actions that weren’t meant to be included within the extra insured protection. Conversely, if a clause is simply too slim, the extra insured won’t be adequately protected for actions explicitly excluded.

Correct interpretation of the clause is important.

Comparability of Insurance coverage Insurance policies, Certificates of insurance coverage extra insured

Completely different insurance coverage insurance policies deal with extra insured protection in various methods. Some insurance policies could provide broader protection, whereas others could have extra stringent limitations. Insurance policies from totally different insurers could use totally different terminology or have various interpretations of comparable clauses. This necessitates cautious evaluate of the particular coverage wording and session with authorized counsel when wanted.

Potential Ambiguities and Challenges

A number of ambiguities and challenges can come up when deciphering extra insured protection clauses:

- Obscure or ambiguous language: Unclear or overly broad language within the clauses can create uncertainty in regards to the scope of protection. Examples embrace clauses that use undefined phrases or depend on subjective interpretations.

- Conflicting clauses: Generally, totally different clauses throughout the similar coverage would possibly contradict one another, resulting in conflicting interpretations and potential disputes. This requires a complete evaluate of your entire coverage doc.

- Lack of readability relating to extra insured’s standing: The certificates won’t explicitly outline the particular obligations or liabilities of the extra insured, creating uncertainty about their protection.

- Completely different interpretations of comparable clauses: Completely different insurance coverage suppliers could interpret related clauses in numerous methods, resulting in inconsistencies in protection throughout insurance policies.

Documentation and Procedures for Further Insured

Securing extra insured protection requires a transparent understanding of the procedures and documentation concerned. This course of ensures each the first insured and the extra insured events are protected beneath the coverage phrases and circumstances. A well-defined course of safeguards in opposition to disputes and clarifies the obligations of every occasion.The method for requesting extra insured protection includes particular steps and documentation.

The insured occasion and the extra insured occasion should adhere to those procedures to make sure the protection is legitimate and successfully utilized. This part particulars the required procedures and documentation required for acquiring extra insured protection, outlining the obligations of each events.

Requesting Further Insured Protection

The method for requesting extra insured protection begins with a proper request. The insured occasion, sometimes the occasion holding the first insurance coverage coverage, should provoke the request. This request ought to clearly determine the extra insured occasion and the particular sort of protection required. The request also needs to element the scope of the work or exercise that the extra insured occasion will probably be performing.

This contains dates and areas of potential work.

Vital Documentation

A number of paperwork are essential for processing a further insured request. These paperwork assist confirm the identification of the events concerned and guarantee compliance with coverage phrases. The first insured occasion should present the next documentation:

- A duplicate of the first insurance coverage coverage, highlighting the related protection sections.

- An in depth description of the extra insured occasion’s actions or work, specifying the dates and areas.

- A affirmation that the extra insured occasion will probably be working beneath the path and management of the first insured occasion.

- A accomplished utility kind specifying the extra insured occasion’s function and obligations.

The extra insured occasion might have to supply extra paperwork, akin to proof of enterprise license or different related info as decided by the insurance coverage supplier.

Tasks of the Insured and Further Insured

Each the insured and the extra insured occasion have particular obligations to make sure the validity and correct utility of the extra insured protection.

- The insured occasion is liable for guaranteeing the accuracy and completeness of the submitted documentation. They’re additionally obligated to inform the insurance coverage supplier of any adjustments within the scope of labor or the actions of the extra insured occasion.

- The extra insured occasion ought to affirm the main points of the protection with the insurance coverage supplier and make sure that their actions adjust to the coverage phrases and circumstances. They should be accustomed to the protection limitations and potential exclusions. They need to additionally guarantee correct communication and record-keeping with the insured occasion and insurance coverage supplier.

Making certain Correct Communication and Report-Protecting

Clear and constant communication between the insured and the extra insured occasion, in addition to with the insurance coverage supplier, is crucial. Common updates on the scope of labor, any adjustments, and the standing of the venture are important. Sustaining detailed information of all communication and documentation is significant for resolving any potential disputes or claims. These information may even assist to confirm the validity of the extra insured protection.

A certificates of insurance coverage, particularly designating extra insureds, is essential for guaranteeing legal responsibility safety extends to numerous events. That is notably pertinent when contemplating pet pleasant lodging, akin to institutions in Kangaroo Valley. For instance, a certificates of insurance coverage for a pet pleasant lodging in Kangaroo Valley like this one should explicitly listing all events, together with visitors and their pets, as extra insureds.

This complete protection is important to mitigate potential claims arising from incidents involving visitors or animals.

- Set up a transparent communication protocol, outlining the strategies and frequency of communication between all events concerned.

- Preserve a complete file of all related paperwork, together with the coverage, purposes, correspondence, and updates.

- Guarantee all events concerned perceive and cling to the agreed-upon procedures and tips.

Potential Points and Options

Further insured protection, whereas useful, can current complexities. Understanding potential pitfalls and proactive options is essential for each the insured and the extra insured events to keep away from disputes and guarantee easy operations. Correctly documented agreements and clear communication are important to mitigate dangers.Further insured protection, although designed to guard a number of events, can result in misunderstandings relating to the scope of safety and the obligations of the events concerned.

Difficulties usually come up from ambiguities within the certificates of insurance coverage, variations within the wording of insurance policies, or an absence of clear communication between the events.

Widespread Issues with Further Insured Protection

A number of frequent points can complicate extra insured protection. These issues usually stem from unclear language within the certificates of insurance coverage or differing interpretations of the coverage phrases. Ambiguous coverage wording or discrepancies between the certificates of insurance coverage and the underlying coverage can result in disputes. Moreover, the dearth of a clearly outlined scope of safety or insufficient communication between the events can create conflicts.

- Coverage Wordings and Interpretations: Completely different insurance coverage insurance policies could use various language to outline extra insured protection. This distinction in terminology can result in differing interpretations, inflicting confusion and doubtlessly disputes relating to the scope of protection.

- Certificates of Insurance coverage Discrepancies: A discrepancy between the certificates of insurance coverage and the underlying coverage phrases can create confusion. The certificates could not totally replicate the boundaries of the protection or the precise phrases and circumstances, doubtlessly resulting in a spot in safety for the extra insured.

- Scope of Protection Ambiguity: A scarcity of readability within the scope of extra insured protection can lead to disputes. It might not be clear whether or not the protection extends to particular operations, areas, or actions. This lack of readability can result in disagreements relating to who’s liable for particular losses or claims.

- Communication Breakdown: Ineffective communication between the events concerned can create misunderstandings. A scarcity of readability within the coverage’s necessities or a failure to promptly deal with issues can lead to disputes.

Potential Conflicts and Misunderstandings

Conflicts usually come up when there are differing expectations in regards to the extent of safety afforded by the extra insured protection. A misunderstanding relating to the coverage’s obligations or obligations can result in disagreements between the events. Moreover, an absence of documentation or insufficient communication can contribute to those misunderstandings.

- Accountability for Claims: Disagreements can come up when there’s uncertainty about who’s liable for dealing with and paying claims beneath the extra insured protection. This uncertainty can stem from ambiguities within the coverage wording or an absence of clear communication.

- Scope of Legal responsibility: Variations in understanding the scope of legal responsibility coated by the extra insured protection can create battle. A scarcity of readability relating to the particular actions, areas, or circumstances coated can result in disputes.

- Coverage Limits and Exclusions: Conflicts could happen if there’s confusion in regards to the coverage limits and exclusions that apply to the extra insured protection. This confusion can come up from ambiguous coverage wording or a lack of know-how in regards to the coverage’s limitations.

Resolving Disputes Relating to Further Insured Protection

A well-defined process for resolving disputes relating to extra insured protection can forestall pricey authorized battles and preserve amicable relationships between events. A transparent and constant course of will help guarantee honest decision and keep away from extended conflicts.

- Evaluate the Certificates of Insurance coverage: Fastidiously evaluate the certificates of insurance coverage and the underlying coverage to know the scope of extra insured protection.

- Doc Communication: Preserve thorough information of all communications associated to the extra insured protection, together with emails, letters, and cellphone calls.

- Search Authorized Recommendation: If the dispute can’t be resolved by means of negotiation, search authorized counsel from an legal professional skilled in insurance coverage regulation to know the rights and obligations of every occasion beneath the coverage.

- Mediation or Arbitration: Take into account mediation or arbitration as various dispute decision strategies to achieve a mutually agreeable resolution.

- Formal Criticism or Authorized Motion: If the dispute stays unresolved, a proper criticism or authorized motion could also be essential. An in depth understanding of the authorized framework is essential in such conditions.

Illustrative Situations

Understanding extra insured protection is crucial for companies and people who could face legal responsibility claims from third events. Correctly structured extra insured endorsements on a business basic legal responsibility coverage can defend in opposition to monetary losses in such conditions. This part offers illustrative situations to spotlight the significance and utility of extra insured protection.

State of affairs Demonstrating Essential Want for Further Insured Protection

A development firm, “Apex Builders,” contracts with a house owner to construct an addition to their home. Apex Builders subcontracts {the electrical} work to “Sparkly Electrics.” The home-owner is injured through the set up resulting from a defective electrical connection. Whereas Apex Builders has basic legal responsibility protection, the home-owner might doubtlessly sue Apex Builders for the negligence of the subcontractor, Sparkly Electrics.

With out Sparkly Electrics being named as a further insured on Apex Builders’ coverage, Apex Builders may very well be held financially liable for damages exceeding their very own protection limits. Further insured protection on Apex Builders’ coverage protects Sparkly Electrics from legal responsibility, thus defending Apex Builders from doubtlessly crippling monetary repercussions.

State of affairs The place Further Insured Protection is Pointless

A contract graphic designer, “Artistic Designs,” creates advertising supplies for a small enterprise, “Native Bakery.” The bakery’s advertising supplies are later deemed deceptive by a competitor, who recordsdata a lawsuit in opposition to the bakery. Nonetheless, the lawsuit is fully targeted on the bakery and the deceptive nature of their advertising. The graphic designer, Artistic Designs, will not be straight concerned within the dispute and isn’t a possible goal of legal responsibility for the declare.

Subsequently, extra insured protection on Artistic Designs’ basic legal responsibility coverage wouldn’t be essential on this state of affairs.

Instance of Further Insured Protection Defending a Celebration in a Legal responsibility Declare

A producing firm, “Precision Components,” contracts with a logistics firm, “Swift Transport,” to ship their merchandise. Swift Transport’s driver causes an accident whereas transporting Precision Components’ merchandise, injuring a pedestrian. The pedestrian sues each Precision Components and Swift Transport for negligence. Precision Components has a basic legal responsibility coverage that features a further insured endorsement naming Swift Transport as a further insured.

This endorsement ensures that Swift Transport is roofed beneath Precision Components’ coverage for the accident. Swift Transport’s legal responsibility declare is thus coated by Precision Components’ coverage, lowering the monetary burden on Precision Components. This can be a key profit of getting a transparent and correctly structured extra insured endorsement.

Instance of Inadequate Further Insured Protection Resulting in Monetary Repercussions

An actual property agent, “Agent Smith,” hires a cleansing firm, “Glowing Clear,” to wash a property earlier than a sale. Glowing Clear damages a helpful vintage vase through the cleansing course of. The home-owner sues each Agent Smith and Glowing Clear for negligence. Agent Smith’s basic legal responsibility coverage contains a further insured endorsement for Glowing Clear, however the endorsement has a restricted protection quantity.

The damages exceed the protection restrict of the endorsement. In consequence, Agent Smith is held liable for the complete quantity of damages exceeding the coverage restrict. This highlights the crucial want for complete extra insured protection to match the potential legal responsibility. Correct coverage limits and scope are important.

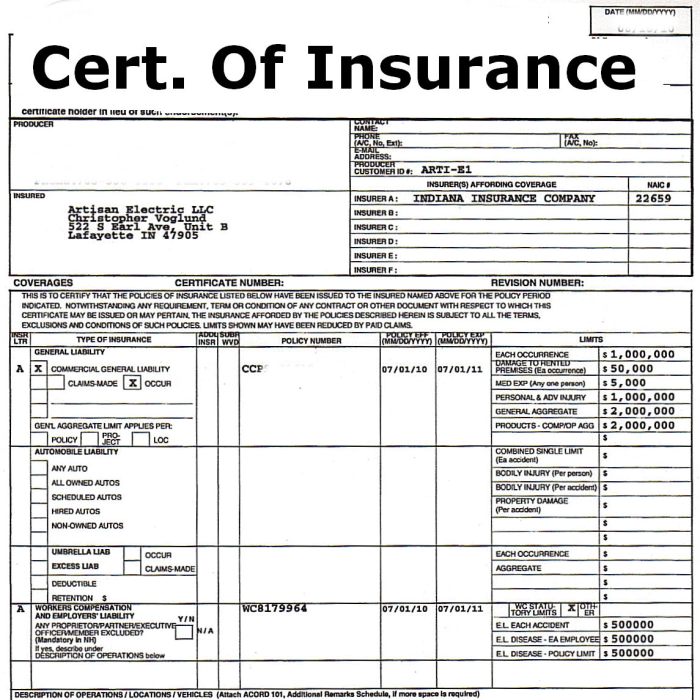

Illustrative Examples of Certificates

Understanding the nuances of extra insured endorsements on certificates of insurance coverage is essential for guaranteeing the right safety of all events concerned. Correct interpretation and utility of those endorsements can forestall pricey disputes and authorized challenges. This part offers illustrative examples to make clear the construction and utility of extra insured endorsements, contrasting conditions with and with out such protection.Certificates of insurance coverage function crucial documentation verifying the existence and scope of insurance coverage insurance policies.

A certificates of insurance coverage, particularly designating extra insureds, is essential for companies dealing with merchandise like meals coloring. This ensures that legal responsibility is correctly distributed in case of incidents. For example, an organization utilizing a product akin to americolor bright white food coloring of their meals manufacturing course of requires a certificates of insurance coverage clearly outlining the extra insured events, together with the shopper using the coloring.

Correct documentation of extra insured statuses throughout the certificates of insurance coverage is paramount for complete threat administration.

Correctly drafted certificates, particularly these together with extra insured endorsements, precisely replicate the contractual obligations of the insurer and the insured events. Inaccurate or incomplete certificates can result in vital misunderstandings and potential liabilities.

Instance 1: Certificates with Further Insured Endorsement

This certificates demonstrates a well-defined extra insured endorsement.

Certificates of Insurance coverage Coverage Quantity: 123456789 Insured: Acme Building Co. Efficient Date: 2024-01-01 Expiration Date: 2024-12-31 Insurer: Common Insurance coverage Firm Further Insured Endorsement: This coverage offers extra insured protection for XYZ Company, ABC Firm, and another particular person or entity performing work on the development website of Acme Building Co., through the coverage interval. Protection applies to legal responsibility arising from operations, however excludes legal responsibility arising from the only negligence of the extra insured. Protection Limits: Normal Legal responsibility: $1,000,000 per prevalence Merchandise and Accomplished Operations: $500,000 per prevalence

The construction of this certificates clearly Artikels the extra insured events.

The coverage quantity, insured, dates, and insurer are normal components. The “Further Insured Endorsement” clause explicitly names the extra insureds and defines the scope of their protection. The protection limits part is essential, because it specifies the extent of legal responsibility safety. Notice the exclusion clause associated to sole negligence of the extra insured. One of these exclusion is frequent and protects the first insured from legal responsibility solely as a result of actions of the extra insured.

Instance 2: Certificates with out Further Insured Protection

This instance showcases a certificates with none extra insured endorsement.

Certificates of Insurance coverage Coverage Quantity: 987654321 Insured: Acme Building Co. Efficient Date: 2024-01-01 Expiration Date: 2024-12-31 Insurer: Common Insurance coverage Firm Protection Limits: Normal Legal responsibility: $1,000,000 per prevalence Merchandise and Accomplished Operations: $500,000 per prevalence

This certificates solely identifies Acme Building Co. because the insured. No point out of extra insured protection is included. This implies solely Acme Building Co.

is roofed beneath the coverage, and different events performing work for them wouldn’t be mechanically protected.

Instance 3: Distinction in Protection Primarily based on Endorsements

Completely different endorsements can considerably alter the protection supplied to extra insureds.

| Endorsement Kind | Protection Scope |

|---|---|

| Named Insured Endorsement | Clearly identifies particular entities as extra insureds. |

| Operations Endorsement | Gives protection for legal responsibility arising from the insured’s operations, encompassing numerous events concerned within the venture. |

| Broad Type Endorsement | Affords broader protection, usually together with legal responsibility arising from the extra insured’s sole negligence however with particular exclusions. |

The desk illustrates how totally different endorsements modify the scope of protection for extra insureds. Named insured endorsements explicitly identify the extra insureds, whereas operations endorsements lengthen protection to events performing work beneath the insured’s path. Broad kind endorsements, whereas providing broader protection, sometimes include exclusions to guard the first insured from legal responsibility stemming solely from the extra insured’s negligence.

Wrap-Up

In conclusion, navigating the world of extra insured protection requires a eager understanding of the intricacies of insurance coverage insurance policies and authorized implications. This information has illuminated the trail to safe partnerships and threat mitigation. By comprehending the assorted elements, together with clauses, documentation, and potential points, you might be empowered to make knowledgeable selections and guarantee a easy, harmonious, and guarded journey.

FAQ Information

What’s the distinction between a further insured and a named insured?

A named insured is explicitly listed on the coverage, whereas a further insured is somebody who positive aspects protection by means of a selected endorsement, usually for a selected venture or transaction. This distinction is essential for figuring out who is roofed and beneath what circumstances.

What are the standard causes for requiring extra insured protection?

Further insured protection is usually required in conditions the place one occasion is working with one other, like contractors engaged on a venture, or a enterprise utilizing one other firm’s companies. This ensures that each one concerned events are protected against potential legal responsibility claims.

How can I decide if extra insured protection is required in a specific state of affairs?

Seek the advice of with authorized counsel or an insurance coverage skilled. Take into account the character of the work, the potential for legal responsibility, and the particular phrases of the settlement.

What are some frequent errors to keep away from when coping with extra insured protection?

Failing to acquire correct documentation, neglecting to evaluate endorsements completely, and never understanding the restrictions of the protection are frequent pitfalls. Cautious evaluate and communication are important.